Goods & Services Tax (GST) | Login

First time login: If you are logging in for the first time, click here to log in.

Goods and Services Tax (GST): Definition, Types, and How It's …

5 days ago · What Is the Goods and Services Tax (GST)? The goods and services tax (GST) is a value-added tax (VAT) levied on most goods and services sold for domestic consumption. The …

Know About GST - Goods & Service Tax, CBIC, Government of India

What is Goods and Services Tax (GST)? It is a destination based tax on consumption of goods and services. It is proposed to be levied at all stages right from manufacture up to final …

Goods and Services Tax (India) - Wikipedia

The Goods and Services Tax (GST) is an indirect tax introduced in India on 1 July 2017, replacing a range of pre-existing taxes like VAT, service tax, central excise duty, entertainment tax, and …

What is GST, Types of GST, GST News, Goods and Services Tax …

Nov 4, 2025 · Learn what is meant by Goods and Services Tax, GST definition, types of GST, GST rates and more GST news here at Business Standard.

Goods and Services Tax: What is GST in India? Indirect Tax

Aug 11, 2025 · GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. The …

Goods and Services Tax (GST) - Definition, Types & Benefits

What is GST in India? Goods and Services Tax (GST) is a tax that India imposes on the supply of specific products and services. The main aim of this taxation system is to to stop the extra …

Goods & Services Tax (GST) | Home

How do I register with GST? How do I apply for refund? How do I file returns? How can I use Returns Offline Tool? How do I file an appeal? How do I file intimation about voluntary payment?

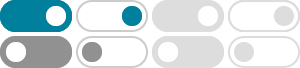

Types of GST: What is SGST, CGST, IGST and UTGST? - ClearTax

Understand the four types of GST in India — SGST, CGST, IGST, and UTGST. Learn how each tax is applied, who collects it, and when it is applicable in intra- and inter-state transactions.

Goods & Services Tax (GST) | Services

Loading...